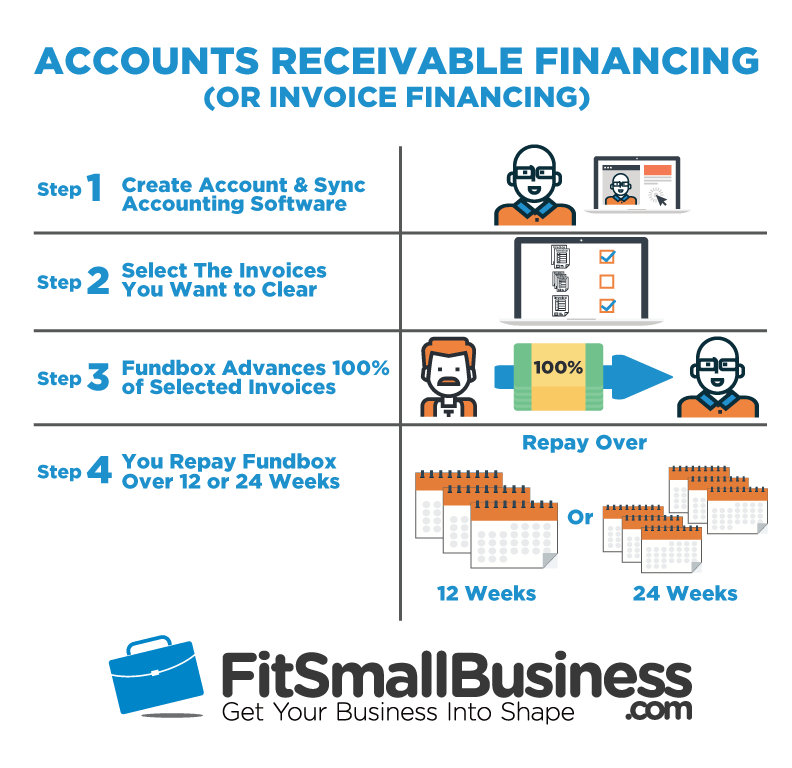

Greater security, Banks are more secure and provide a sense of financial stability.Businesses that work with a bank-owned factoring company may also have a better portfolio transitioning to a commercial loan at a later date. Many of these businesses have been told “no” by a bank for a commercial loan, but they are still candidates for working with a bank that offers factor or accounts receivable financing. Easier transition to a bank loan, A bank factor works with many businesses that are considered outside the traditional credit box.Bank factoring companyĪ bank factor provides the same flexibility and benefits as an independent factor and offers additional advantages. That can be risky as it increases costs for your business, reducing efficiency. However, an independent factoring company must borrow from a third party to fund your invoices. Independent factoring companies usually are for businesses that need to accelerate cash flow and may have been rejected by a bank. Let’s take a look at them: Independent factoring company However, there are some differences whether you choose to work with a bank or a factoring company. So the application is very straightforward. This step allows small businesses to unlock the cash value of their invoices before they receive payment from customers. Once your client pays their invoice to the factoring company, you’ll get the rest of the money due to your business minus the factoring company’s fees. The factoring company buys a business’s unpaid invoices at a discount. This company can also be a bank that allows you to apply for a factoring account. The remaining 10-20% less factoring fee of the invoice value is released to the Seller, for example, on Day 26).Ī factoring company provides invoice factoring services.The Debtor credit payment to the Factoring Company, which goes into a lockbox in the Seller’s name (for example, on Day 25).The Factoring Company advances between 80-90% ( as agreed between the seller and Factoring company) of the invoice value to the Seller, deposited into their business bank account.The Seller submits another copy of that invoice with delivery order to the Factoring Company for funding (for example, on Day 1).The Seller completes a service or delivers a product, then sends an invoice to the Debtor.The Debtor (Business Debtor)The Factoring (The factoring company or bank).Here are three parties involved in the transaction:

However, invoice factoring allows a factoring company to give you cash upfront in place of client payments. Invoice factoring is a financial product in which you sell your accounts receivable to a third-party factoring company in exchange for cash upfront.īank Business loans require complete applications where the bank qualifies your special status. Therefore, we recommend trying invoice factoring to ease the cash crunch. That prevents the business from investing in growth opportunities or maintaining day-to-day operations that keep everything on track.

The unaccountable cycle puts many small business owners in a constant cash crunch, making it hard to keep up with monthly expenses like payroll, utilities, or inventory. You’re unlikely to be able to utilize that money for this period. The actual cash will only flow in at least a month or longer. Most business collections are set to credit terms of 30 to 90 days, meaning that an invoice is posted to your customer at the point of transaction. We recommend that you use invoice factoring to alleviate your financial stress. If you are experiencing this stress, it’s time to consider another finance management strategy to ease cash flow. This tip is a timely reminder for business owners with different financial stress points, including business owners who wait for clients to pay their outstanding invoices while the creditor calls hourly. A recommended tip by consultant firm McKinsey is that firms must “cast a wider net for new efficiency opportunities,” going beyond mere transactional activities.

0 kommentar(er)

0 kommentar(er)